Payroll tax calculator 2023

Get Started With ADP Payroll. The payroll tax rate reverted to 545 on 1 July 2022.

Listentotaxman Uk Paye Salary Tax Calculator 2022 2023

The maximum an employee will pay in 2022 is 911400.

. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Unemployment insurance FUTA 6 of an.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Financial advisors can also help with investing and financial planning - including. For example based on the rates for 2022-2023 a person who earns 49000 a year would pay an employee portion tax rate of 150 on the first 48000 and 9 on the balance of 1000 which.

The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to. See where that hard-earned money goes - with UK income tax National Insurance student. It is mainly intended for residents of the US.

It will be updated with 2023 tax year data as soon the data is available from the IRS. Plug in the amount of money youd like to take home. Print a record of federal state and local.

Well calculate the difference on what you owe and what youve paid. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Get Started With ADP Payroll. Ad Process Payroll Faster Easier With ADP Payroll. Click here to see why you still need to file to get your Tax Refund.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local Sales Taxes Real Estate Transfer Fees Federal State and Local Consumer Taxes Gasoline. 2022 Federal income tax withholding calculation.

Subtract 12900 for Married otherwise. Calculator And Estimator For 2023 Returns W 4 During 2022 Payroll taxes change all of the time. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

Ad Process Payroll Faster Easier With ADP Payroll. If youve already paid more than what you will owe in taxes youll likely receive a refund. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

There is also a special payroll tax rate for businesses in bushfire affected local government. Ad Compare This Years Top 5 Free Payroll Software. For 2022-23 the rate of payroll tax for regional Victorian employers is 12125.

To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. Free Unbiased Reviews Top Picks. The standard FUTA tax rate is 6 so your max.

Subtract 12900 for Married otherwise. Free SARS Income Tax Calculator 2023 TaxTim SA. Ad Compare This Years Top 5 Free Payroll Software.

Enter up to six different hourly rates to estimate after-tax wages for hourly employees. All Services Backed by Tax Guarantee. Ad Payroll So Easy You Can Set It Up Run It Yourself.

See your tax refund estimate. A financial advisor in New York can help you understand how taxes fit into your overall financial goals. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. And is based on the tax brackets of 2021 and.

Free Unbiased Reviews Top Picks. Prepare and e-File your. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Calculate 2022 23 Uk Income Tax Using Vlookup In Excel Youtube

![]()

Canada Income Tax Calculator 2022 With Tax Brackets Investomatica

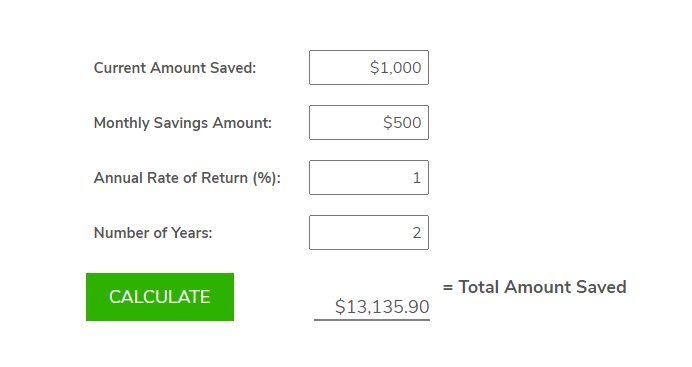

Free Simple Savings Calculator Investinganswers

Tax Calculator Estimate Your Income Tax For 2022 Free

Supremecapitalgroup On Twitter Personal Financial Management Financial Institutions Financial Management

H R Block Tax Calculator Services

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

The Salary Calculator Hourly Wage Tax Calculator Salary Calculator Weekly Pay Loans For Poor Credit

South Africa Tax Calculator 2022 2023 Calculate Your Tax For Free Youtube

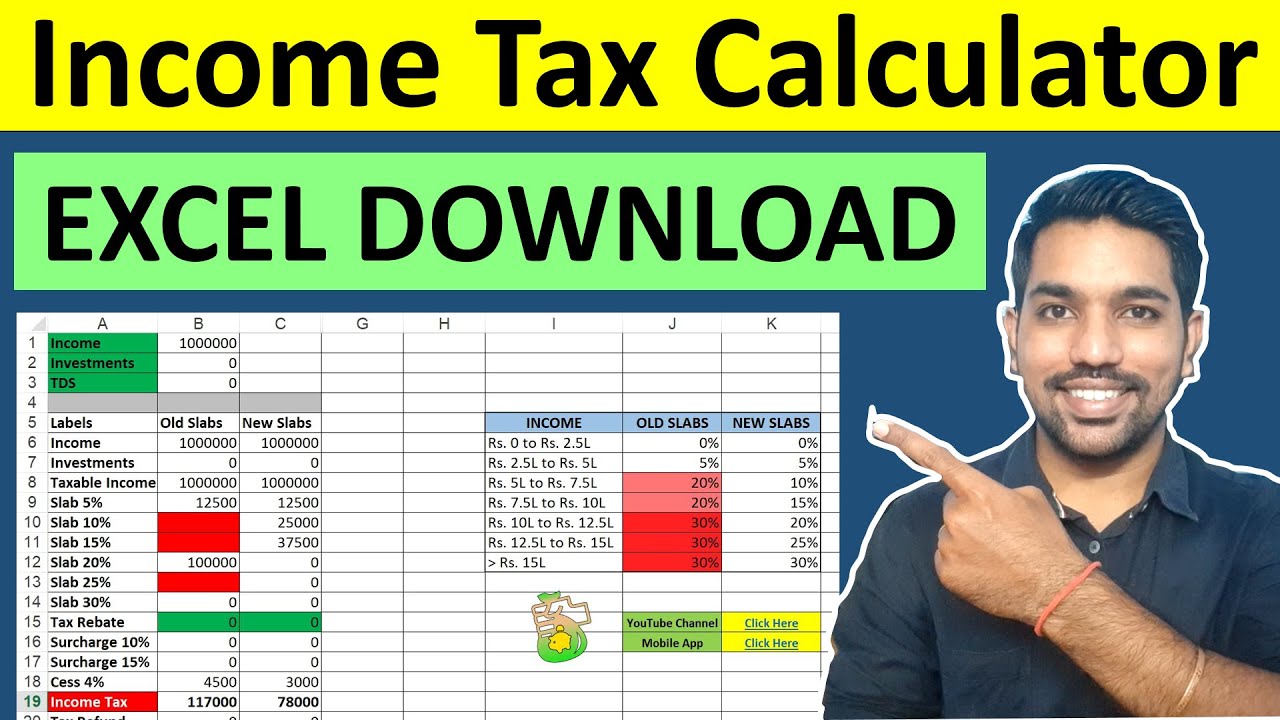

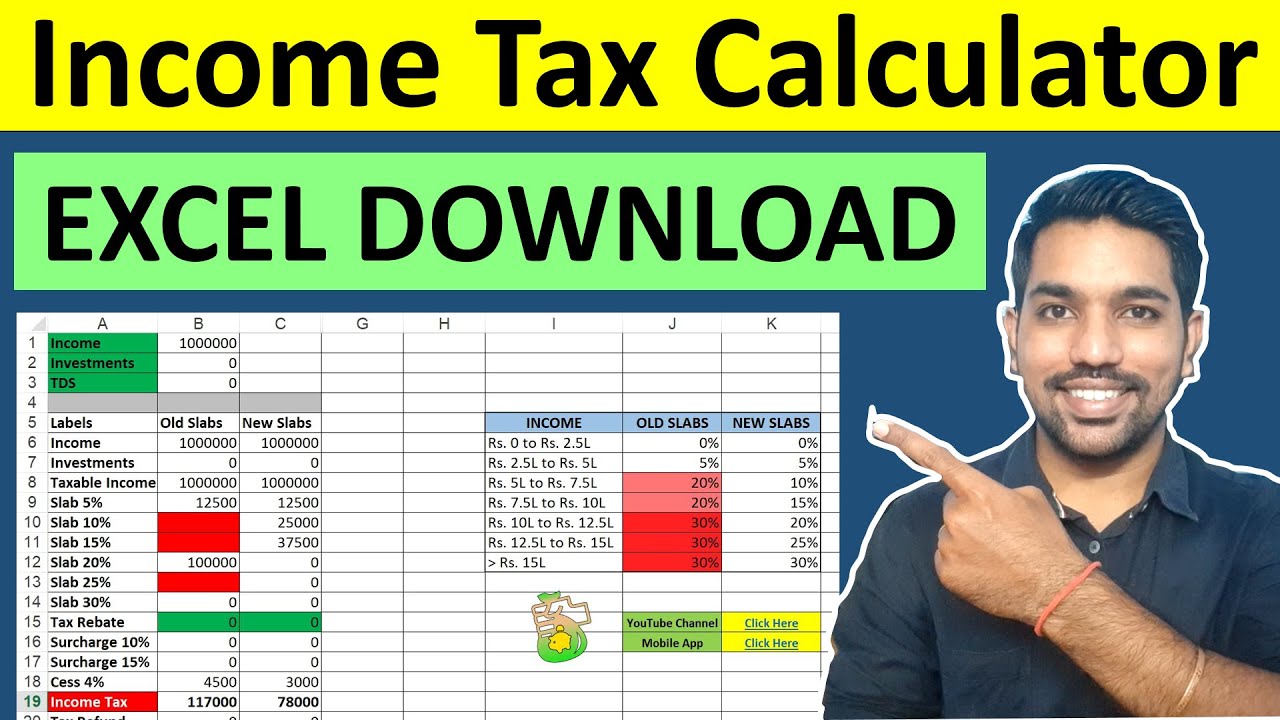

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

H R Block Tax Calculator Services

2021 2022 Income Tax Calculator Canada Wowa Ca

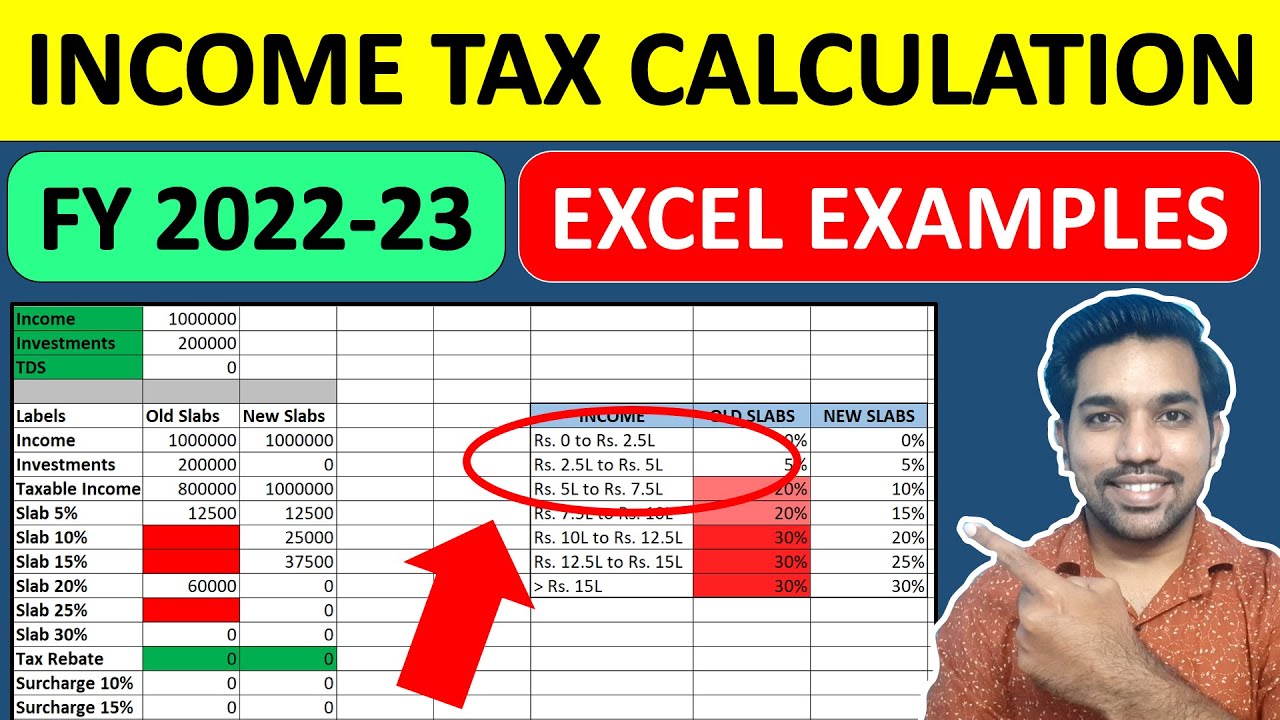

Income Tax Calculation 2022 23 How To Calculate Income Tax Fy 2022 23 Excel Examples Tax Slabs Youtube

![]()

Canada Income Tax Calculator Your After Tax Salary In 2022

Simple Tax Calculator For 2022 Cloudtax

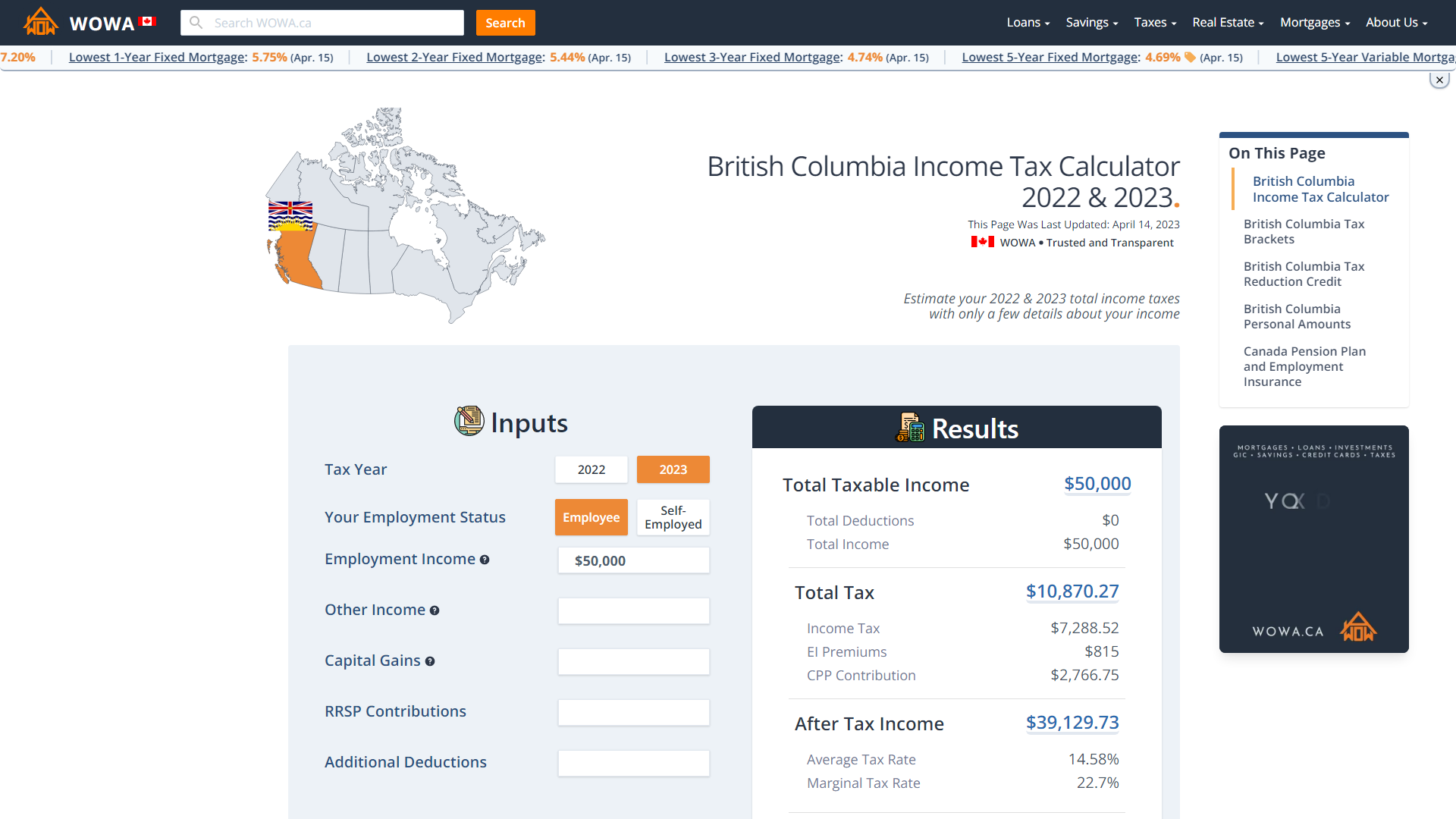

Bc Income Tax Calculator Wowa Ca

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator